This article is not a replacement for the guidance given by medical professionals nor official advice provided by the UK Government on Covid-19. You must always follow the latest Government advice on Covid-19.

BPCA has also created a guide for pest management businesses returning to work, once lockdown measures are eased again across the UK.

The document is available to both members and non-members, and can be downloaded as a .pdf below.

Becoming Covid-19 secure

Latest update: 9 December 2021

The outbreak of New Corona Virus 2019-nCoV, commonly known as Coronavirus or Covid-19, in the central Chinese city of Wuhan in Hubei Province, has had a major impact across the globe.

The UK Government is posting daily updates on the situation in the UK, including the risk level and advice for travellers, which can be found here.

In this guide:

Position statement: Covid-19

BPCA is fully aware of the importance of protecting public health. Our members make their living by protecting homes and businesses from public health pests.

Covid-19 presents a very real threat to public health and to the most vulnerable in our society.

It is everyone’s responsibility to help protect the nation from the spread of the virus by following official government advice, particularly by avoiding all unnecessary contact and practising social distancing.

However, pest management requires professionals to visit sites and deal with clients face-to-face.

In some situations, pest professionals will be around the most vulnerable to protect them from public health pests.

Professional pest management is a critical service that supports public health, however the risks of spreading Covid-19 need to be balanced against the risk of inadequate control and management of pest species.

This should be done on a case-by-case basis and is a business decision for individual pest management companies with their client.

Becoming Covid-19 secure

Following government announcements on 23 June 2020 regarding the reopening of many businesses and an easing of lockdown restrictions, we put together some guidance for pest management companies.

On 4 January 2021, the UK government announced another full and immediate lockdown of the country. We've reviewed the below guidance and are confident that it still stands, as pest management is an essential service which should remain open during this current lockdown period.

Disclaimer and limitations of guidance

BPCA staff are not Covid-19 experts, and our guidance is created by applying the UK Government’s guidelines to the pest management sector and further research into the virus from organisations such as the NHS and the World Health Organisation (WHO).

This guide is not a replacement for the guidance given by medical professionals nor official advice provided by the UK Government on Covid-19.

You must always follow the latest Government advice on Covid-19.

Ultimately, BPCA cannot tell you what to do in every situation your company will come across. Pest management company owners and senior managers will ultimately be the ones to make the decisions in any given business.

Your risk assessments and risk mitigation measures will be unique to your business, processes and risk assessments.

Introduction

Covid-19 is an invisible threat to our lives and businesses on a scale we’ve not seen in a lifetime.

Some people carry the disease asymptomatically without ever knowing they’re infectious. Those who develop symptoms often don’t show signs of the virus for five days or more.

Even those who are not at risk of significant harm themselves may pose a real risk of inadvertently infecting others.

Our greatest risk at this time is an increase in the rate of infections, burdening the NHS, endangering more lives and damaging our businesses.

This is not a short-term crisis. The UK Government says it is likely that Covid-19 will circulate in the human population long-term, possibly causing periodic epidemics.

Every sector must do its part to ensure the UK doesn’t have a second peak. While pest management is essential, by the nature of our work the risk of spreading the virus could be high if we do not adapt our practices.

On 10 May 2020, Prime Minister Boris Johnson addressed the nation to outline his plan for the UK’s Covid-19 recovery strategy, calling for businesses to become “Covid-19 secure”, along with issuing various guidance documents.

While BPCA had previously published guidance for pest management companies that continue to provide essential services as key workers, we’ve updated that guidance.

There is now more general advice for pest management companies on how to protect their workforce and clients from Covid-19.

As lockdown restrictions are eased in some areas of the UK, pest management companies will likely take on more of the work that may have been unavailable to them during the previous lockdown stages of the pandemic. Other companies that have temporarily closed will begin to reopen, increasing the demand for pest management.

This guidance aims to keep you safe and also to minimise the risk of spreading or contracting Covid-19.

BPCA offers this guidance freely to any pest management company. We hope this guide proves useful and that it’ll help you make changes to your business, so we can all do our part in slowing the spread of Covid-19.

Stay safe and thank you for continuing to protect public health.

Kind regards,

IAN ANDREW

BPCA Chief Executive

ian@bpca.org.uk

Government guidelines

Public health is devolved in Northern Ireland, Scotland and Wales. This guidance should be considered alongside local public health and safety requirements and legislation in Northern Ireland, Scotland and Wales.

All devolved governments agree that pest management businesses can continue to work, and our guidance will be helpful for pest companies across the UK.

However, you need to check governmental Covid-19 guidance in every nation you operate in.

England

gov.uk/coronavirus

Scotland

gov.scot/coronavirus

Wales

gov.wales/coronavirus

Northern Ireland

nidirect.gov.uk/campaigns/coronavirus-covid-19

REMEMBER When you operate across borders, you need to check the local guidelines and regulations.

| |

Essential work for public health and safety

|

Non-essential

work |

Social distancing

and health and

safety requirement |

Only when

you can't work

from home |

| England |

Y |

Confirmed as key workers |

Y |

Y |

Y |

| Scotland |

Y |

Confirmed as key workers |

Y |

Y |

Y |

| Wales |

Y |

BPCA believes pest professionals are covered,

but Government has yet to confirm |

Y |

Y |

Y |

| Northern Ireland |

Y |

Confirmed as key workers |

Y |

Y |

Y |

Differences between nations

England

At the time of writing (December 2021) all businesses in England are remaining open, including nightclubs. Schools are open and operating under government safety guidance. Events are taking place, many with requirements to provide negative Covid tests or proof of vaccine before entry.

Face masks are once again compulsory on all public transport and in most indoor public places - see the full list and guidance here.

Office workers who can do so are being asked to work from home once again, starting Monday 13 December 2021 - there are no changes to the rules regarding those who can't work from home, such as pest professionals.

Even if the rules tighten, we anticipate pest professionals will be continue to work as our sector is considered key workers.

Find out more about the restrictions in England here.

Scotland

There are no current protection levels or tiers in place in Scotland, however advice remains to meet outdoors if you can, take regular Lateral Flow Tests and work from home where possible.

It is also required that you wear face masks in certain public places - see the full list and guidance here.

For complete guidance on Covid-19 in Scotland, visit the gov.scot website.

Wales

Most restrictions have now been lifted in Wales. However you still need to wear a face covering in many places, including public transport. Advice is to take reasonable measures to stay safe where you can.

From 15 November, if you are over 18, you must show the NHS Covid pass to enter theatres, cinemas and concert halls.

Find out more about current restrictions in Wales.

Northern Ireland

The Government in Northern Ireland is continuining to urge citizens to "make safer choices", such as continuing social distancing if you feel it is necessary.

Some of the guidance includes:

- Book a test and self-isolate for 10 days if you have COVID-19 symptoms

- Get a PCR test if you've been identified as a close contact and self-isolate if you haven't been fully vaccinated

- Wear a face-covering on public transport and all indoor public settings - see full guidance here

- Keep your distance from others

- Limit your contacts.

For a full picture of the guidance in Northern Ireland, visit the Ni Direct website.

Risk assessments

It’s been advised that a Covid-19 risk assessment must be done for all businesses with five or more employees. However, BPCA highly recommends all companies, regardless of size, carry out a risk assessment relating to the risk of contracting or spreading Covid-19.

Risk assessments are a vital tool to justify your decisions and actions as a business, should the need arise. Some key points to consider are:

- The ways that the virus could be transmitted from and to clients

- Identify activities and locations where transmission is more likely

- Apply the hierarchy of control to develop a control strategy.

Risk assessments need to be discussed with employees to ensure that they are fully aware of all control measures.

Risk assessments must be reviewed regularly as per Government guidance.

Risk assessments must be approved by the nominated person for health and safety before being issued as a live document.

Once you’ve filled in your risk assessment, it should be made available for all employees to read and sign to acknowledge their understanding.

For businesses with over 50 employees, the Government expects that, if you are able to, you should publish the results of your risk assessments on your website.

Support for BPCA members

Risk assessment templates are available to BPCA members in the member area (login required). You can also demonstrate good practice by using a toolbox talk template, also in the BPCA member area, to discuss the risk assessment and how technicians can practically implement the control measures.

bpca.org.uk/member-documents

Employee health

NEW: If you’re a contact of someone who may have been infected with the Omicron variant, you must self-isolate for 10 days, regardless of your age, vaccination status or any negative test results.

Anyone with a positive Covid-19 test result must stay at home for the full isolation period.

This is because they could pass it on to others, even if they don’t have symptoms.

If someone has a positive test result but do not have symptoms, they must still stay at home and self-isolate as soon as they receive the results.

The isolation period includes the day symptoms started (or the day test was taken if you do not have symptoms), and the next 10 full days.

This means that if, for example, symptoms started at any time on the 15th of the month (or if they did not have symptoms but the first positive COVID-19 test was taken on the 15th), the isolation period ends at 23:59 hrs on the 25th.

You can find more information about that on the Gov UK ‘guidance for households with possible infection’ page.

You should also consider following our guidance on test and trace procedures where necessary.

Before returning to work, all employees should complete a screening questionnaire to address any possible exposure to the virus.

When you do not need to self-isolate

Note: If you’re a contact of someone who may have been infected with the Omicron variant, you must self-isolate for 10 days, regardless of your age, vaccination status or any negative test results.

If someone you live with has symptoms of Covid-19, or has tested positive for Covid-19, you will not need to self-isolate if any of the following apply:

- you're fully vaccinated – this means 14 days have passed since your final dose of a Covid-19 vaccine given by the NHS

- you're under 18 years, 6 months old

- you're taking part or have taken part in a Covid-19 vaccine trial

- you're not able to get vaccinated for medical reasons.

If an employee develops symptoms of Covid-19, but any of the circumstances above apply, it will be down to your own risk assessments and discretion as to whether or not you allow them to attend work.

You should approach all aspects of work within the hierarchy of risk control framework.

Every decision you make must be justified on the basis that it is the safest and most reasonably practicable option available to you.

Above all, you must ensure that those employees who cannot work from home can instead observe social distancing measures wherever possible.

BPCA members have access to an employee screening questionnaire in the BPCA member area (login required).

Clinically extremely vulnerable individuals have been strongly advised not to work outside the home.

Clinically vulnerable individuals, who are at high risk of severe illness (for example, people with some pre-existing conditions), have been asked to take extra care in observing social distancing and should be helped to work from home, either in their current role or in an alternative role.

You should create a procedure for what steps will be needed if there is an occurrence of the virus in your workplace once you have reopened.

Mental health support

There are, rightly, many concerns about mental wellbeing and how people are coping during this unprecedented time.

In the most recent BPCA survey, 45% of pest professionals polled reported that the pandemic had affected their mental health.

Back-to-work does not mean back-to-normal, and the mental health effects of this situation will be long lasting for many people.

Employers should be mindful of the stress that returning to work during this time may put on employees, and support staff with this transition as much as possible.

Here are some of the ways experts suggest you can limit the impact on your mental health

- 'Facts minimise fear'. Misinformation and uncertainty can cause stress, so it’s important to make sure that, if you’re looking for information on Covid-19, you use trusted sources. These include the World Health Organisation and the Government

- If you are in isolation, try to stay in contact with people using technology such as video calling

- Keep to your routine as much as possible, exercise regularly and practise hobbies or interests.

If your employer is a member of the Health Matters Assistance Programme, you can receive free mental health support by visiting their website or calling their helpline number on 0800 988 8809.

You can find more mental health and wellbeing support on the following websites:

nhs.uk/conditions/stress-anxiety-depression/mental-health-helplines/

mind.org.uk/information-support/guides-to-support-and-services/seeking-help-for-a-mental-health-problem/where-to-start/

rethink.org/aboutus/what-we-do/advice-and-information-service/get-help-now/

mentalhealth.org.uk/getting-help

Travelling to and from work

Government guidelines suggest that, wherever possible, you should walk, cycle or drive a car to work.

Where this is not feasible, and you have to take public transport, consider the following:

- Check with your travel operator before making your journey, as there may be revised times and routes in place or rules that you are expected to adhere to, such as wearing masks

- Plan alternative routes for your journey, in case of unexpected disruption to the service

- Try to be more aware of your surroundings, including any floor markings or notices regarding social distancing

- Consider booking travel online or using mobile apps, or pay through contactless payment methods instead of cash

- Where possible, try to sit or stand apart from other travellers

- Avoid eating or drinking anything while on public transport

- Do not touch your face and wash your hands as soon as is practicably possible upon leaving public transport

- Foot technicians should carry cleaning wipes and clean down kit bags after using public transport.

It is now currently compulsory to wear a face-covering while travelling - this does not need to be at the same level of PPE that you will need to wear once you are in a client’s home or business but should still correctly cover your nose and mouth.

You should wash your hands before putting it on and after taking it off.

If you are an employer, you should try to make arrangements for staff who have to take public transport to work flexible hours, for them to travel at less busy times.

You might also consider arranging for staff to take taxis, particularly if you have concerns about foot technicians travelling on the London Underground.

You can find more advice about safer travelling on the Gov UK website.

Using vans

Firstly, you should consider limiting pest technicians to one per van wherever possible, as it is not possible to keep a 2m distance in a vehicle.

Where you may previously have sent out technicians in pairs, you should now consider putting technicians on shifts or acquiring extra vehicles where needed.

If technicians have no other options but to share a vehicle, you could install a plastic divider or drop-down screen to separate the driver and passenger seats.

PPE should be worn, however this can be a face-covering similar to that worn on public transport.

Although using a van will be safer than using public transport, drivers should still take hygiene precautions:

- Wash your hands for at least 20 seconds before leaving your home and when you return

- Wipe down your vehicle door handles and, particularly if you share the vehicle with others, wipe down the steering wheels, gear stick etc. before and after using the van (employers should provide staff with cleaning products to do this)

- Give the vehicle a thorough clean more regularly, including the seatbelts, mirrors or any surface that may have been touched

- When refuelling, use disposable gloves and pay at the pump and/or use contactless payments where possible; stay 2m away from other motorists at all times; use hand sanitiser upon returning to your vehicle.

Maintenance

If you have an MOT that’s due from 30 March 2020, the Government announced that you would automatically receive a six-month extension.

You are advised to check online three days before your vehicle’s MOT was originally due to expire, to ensure it’s been extended. More details are on the Gov UK website.

UPDATE: Heavy vehicle testing resumes (26 June 2020)

The DVSA have announced that from 4 July, they are restarting testing for heavy vehicles.

They have issued a 3-month exemption for vehicles due to be tested in June and will issue further exemptions for July tests to help them manage demand as they resume testing.

How does the exemption work?

The exemptions will be applied automatically. You can use the MOT history service to check the expiry dates for your vehicles.

In August, vehicles which have already received an exemption will need a test. All other vehicles due for a test in August will receive a 3-month exemption. When those exemptions expire, vehicles will need to be brought in for test.

Which vehicles will be due for tests, when?

- If your MOT was due in March 2020 your vehicle must pass its MOT by 30 September 2020 (your vehicle has already been given two 3-month exemptions)

- If your MOT was due in April 2020 your vehicle must pass its MOT by 31 October 2020 (your vehicle has already been given two 3-month exemptions)

- If your MOT was due in May 2020 your vehicle must pass its MOT by 31 August 2020 (your vehicle will get one 3-month exemption)

- If your MOT is due in June 2020 your vehicle must pass its MOT by 30 September 2020 (your vehicle will get one 3-month exemption)

- If your MOT is due in July 2020 your vehicle must pass its MOT by 31 October 2020 (your vehicle will get one 3-month exemption)

- If your MOT is due in August 2020 your vehicle must pass its MOT by 30 November 2020 (your vehicle will get one 3-month exemption).

More information is available on the Gov UK website.

Breakdowns

Check your breakdown cover is still up-to-date and paid for.

In the event of a breakdown, you must always have certain things in your vehicle, pandemic or not, such as a warning triangle and high-visibility vest.

However, you should also begin to consider extras, such as keeping a spare tyre that is road legal, and a jack and a tool to remove the wheel nuts.

In the event of a flat tyre, you would be able to replace it yourself instead of calling out a vehicle repair or breakdown service.

If you want staff to be able to change their own tyres you should have a risk assessment and safe system of work to allow this.

It may be worth investing in a set of jump leads, which could help you get back on the road quickly if you can find a friendly motorist (while maintaining social distancing) to charge your battery.

However, jump-starting a car is not necessarily straightforward, so you should only do this if you feel competent and safe, and if you are not sure you should call your breakdown provider instead.

For further information and guidance on transport and travel during Covid-19, visit the Gov UK website.

Pest control work on-site

Protecting people from the dangers of public health pests is essential for maintaining health and safety.

During the Covid-19 pandemic, you need to be extra careful when entering homes or businesses.

Minimise visits to clients where possible

BPCA has updated the thought process for “Should I go on a job during the Covid-19 pandemic?” to reflect current guidelines.

BPCA can’t tell you whether you should or shouldn’t be doing a specific job. However, we’ve developed a thought process you may choose to follow or incorporate into a risk assessment before you visit a site.

Each step encourages you to assess and mitigate the risks to yourself and your clients as best you can. The process should be followed before every job and dealt with on a case-by-case basis.

Common sense actions

It would help if you were particularly strict about hand washing, coughing and sneezing hygiene, such as covering your nose and mouth with your elbow and disposing of single-use tissues.

You should extend your use of PPE and wear it at all times.

Before going to any site, ask yourself:

1. Do you need to be on-site?

- Will hygiene or proofing advice stop the problem or at least keep the infestation in check until it is safer to do a visit?

- Can pest awareness training over the phone or via video conference be sufficient to protect a site for the short term?

- Can routine visits be missed if on-site employees are trained to do basic monitoring?

- Can any part of the work be done remotely by video call?

- Can your survey be done remotely with a trusted employee already on-site?

- Can you confirm infestations of domestic properties with photographs from the client?

- Think about finding digital or remote alternatives to physical, in-home work where possible, such as video or phone consultations.

2. Have you checked who is on site and if they’re well?

- Are you sure no-one is currently self-isolating in the premises?

- Have you asked your client if everyone is well on-site?

- Is anyone on-site shielding or a clinically vulnerable person?

Call your client in advance and check all the above.

No work should be carried out in a household where:

- Someone is isolating

- Where someone has symptoms

- Where an individual has been advised to shield (unless necessary precautions are taken to ensure their wellbeing, such as never being in the same room).

The only exception for this is when your risk assessment allows it to remedy a direct risk to the safety of the household – for example, an acute infestation by a public health pest.

3. Do your staff have what they need to keep themselves safe?

- Do they have the correct PPE and handwashing facilities?

- Are staff health record up-to-date?

- Do you know for certain the technician isn’t in a high-risk group?

- Do staff understand your risk assessments and know how to put them in place?

- Do staff understand the new safe working procedures and know how to put them in place?

- Are you and your staff up-to-date with current government and sector guidance, and can you demonstrate this?

Employers have a legal responsibility to protect workers and others from risk to their health and safety.

This means employers need to think about the risks they face and do everything reasonably practicable to minimise them, recognising you cannot completely eliminate the risk of Covid-19.

Choosing not to visit premises

Ultimately, it is a business decision for each company and their clients to decide whether or not to visit a site.

If you or your client decide not to arrange a visit, make sure any glue boards are removed, and any live capture traps are deactivated.

If you have any rodenticide in sites that have a high risk of re-infestation (eg permanent baiting strategy) label restrictions need to be adhered to.

If you have any concerns that you may not be able to visit at minimum legal frequencies, then it may be best not to use rodenticides in these cases. Always use pesticides in accordance with the label requirements.

Remember

No one is obliged to work in an unsafe work environment, and risks must be mitigated to make sure you have a safe working environment.

Employers and agencies should keep in touch with workers, who they might usually meet with face-to-face, on their working arrangements including their welfare, mental and physical health and personal security.

Managing risks during a visit

If a physical visit is needed, discuss the working environment and practices with householders and clients in advance to confirm how the work will be carried out.

- Maintain 2m social distancing wherever possible, including on a client’s site

- Discuss with your client ahead of a visit to ask that a 2m distance is kept from those working and advise that if this is not adhered to, technicians reserve the right to leave the premises for their own safety

- Ask clients to leave all internal doors open to minimise contact with door handles

- Identify busy areas across the site where people travel to, from or through, for example, stairs and corridors, and minimising movement within these areas

- Wash your hands with soap and water often – do this for at least 20 seconds

- Wash your hands before and after visiting a client’s site

- Use hand sanitiser gel if soap and water are not available

- Do not consume food and drink on the client’s site, and take your own food and drink which you can consume outside

- Take any breaks outside

- Do not share pens with your client

- Send paperwork digitally wherever possible

- Communicate with your client over the phone, even if you’re on the same site, if possible

- If you must speak with a client face-to-face, do this outside or in a well ventilated room while maintaining social distancing

- Cover your mouth and nose with a tissue or your sleeve/elbow (not your hands) when you cough or sneeze

- Put used tissues in the bin straight away and wash your hands afterwards

- Try to avoid close contact with people who are unwell

- Do not touch your eyes, nose or mouth if your hands are not clean

- Pay particular attention to situations where you are undertaking actions where items may have passed through many hands, eg cash handling

- Keeping the activity time involved as short as possible

- Work on your own wherever possible (or work back-to-back if this isn’t possible)

- Reduce the number of people you have contact with by using ‘fixed teams or partnering’ (so each person works with only a few others).

Personal protective equipment (PPE)

Where you are already using PPE in your work activity to protect against non-Covid-19 risks, you should continue to do so.

However you must now wear a face mask at all times, when you are carrying out work indoors. Any PPE provided to employees must fit properly.

Let your customers know that you will be extending your use of these to include your arrival on-site. If at all possible, use disposable items so you can wear a new set on the next job.

Let your clients know of any additional costs because of precautionary measures taken at this time, making it clear that you are taking these steps for your own safety and that of your clients.

Some key points to consider are:

- You should not substitute frequent hand washing for PPE – continue to practice good hygiene, even if you have been wearing gloves

- Reusable PPE should be thoroughly cleaned and stored and should not be shared with multiple users

- Single-use PPE should be disposed of as soon as finished and treated as clinical waste

- In between carrying out pest control jobs, you may feel it is useful to wear a face covering. It is worth remembering that these are marginally beneficial as a precautionary measure, to protect others if you are infected but have not yet developed symptoms

- Wearing a face covering in most public places is optional and is not required by the law. If you choose to wear one, it is important to use it properly, and wash your hands before putting it on and after taking it off.

Offices and shared areas

These guidelines will cover offices, fixed premises, pesticide stores or any environments shared by employees.

Communication and procedures

Signs should be visible in all areas of the workplace, highlighting social distancing rules and hygiene practices.

For example, if you have an equipment/pesticide store that technicians need to visit to re-stock, make sure they understand that they must be 2m apart at all times. Consider devising a rota for store visits.

You must share with employees any changes that are happening and mitigation measures in place. This is a legal responsibility as well as a moral one.

To do this, you need to make sure that you have effective communication channels in place, including emergency contact details.

Consider creating an internal communications strategy, including regular email updates with any advice, news or changes in procedure.

You may also want to think about giving training for any new procedures that are in place, and having employees sign a document to say they have received and understood the training.

Access

- Make sure you record any visits to shared workspaces or offices on a log sheet

- Plastic screens should be used to avoid face to face contact – if technicians need to share a vehicle, drop-down screens can be fitted to protect the occupants

- Where possible restrict or stop all visits to the workplace that are unnecessary

- Install barriers or floor markings to ensure social distancing while waiting to enter/exit the workplace or store.

Limiting numbers

Where possible, reduce the numbers of employees on-site at any one time:

- Introduce a shift system to reduce numbers of workers at any one time

- Reduce the numbers in teams and desks to an office as a temporary arrangement

- Additionally, if your office has a hot-desking policy then this must be revised. Staff are more at risk when sharing work stations.

There are various factors to consider and ways to control the use of welfare facilities. These include:

- Reduce the number of employees in break rooms by introducing staggered dinner breaks

- Reduce the number of chairs or tables in the break room to ensure social distancing is adhered to

- Provide hand gels and sprays for wiping down communal items such as microwaves, kettles etc

- If you have toilet facilities with multiple cubicles, introduce a ‘one in, one out’ policy

- Ensure there are signs in the bathroom to encourage thorough hand washing and general hygiene

- Consider field workers who may have limited access to toilets due to the lockdown - there are apps available to locate nearby facilities and their status in terms of open or closed. Research should be done and shared with employees.

Cleaning

You should implement a more frequent and robust cleaning regime. This must include all areas which may not usually be part of the daily cleaning regime, such as:

- Vehicles

- Air conditioning ‘deep clean’

- Handrails on stairs

- Door handles

- PCs, mice, keyboards

- Printers

- Telephones.

Cleaning products should be sourced for ‘anti-viral’ cleaning as Covid-19 is a virus, not a bacterium.

If you have a cleaning contractor, ensure you have a procedure for them to carry out their contract while still observing social distancing, such as changing their hours so that cleaning takes place when the office is closed.

You should also communicate with them beforehand on issues such as PPE and extra cleaning products. It may be that they already have extra PPE or you may want to provide these.

Adequate ventilation also helps minimise the risk of Covid-19 transmission. You can read our full article on ventilation on our website.

Guidance on test and trace procedures for pest management companies

Introduction

As responsible citizens and business owners, we should all be doing our best to minimise the risk of spreading Covid-19 and prevent the NHS from being overwhelmed.

As pest management professionals, this can be tricky. Our people have to visit multiple sites in one day, putting them at a higher risk of catching and spreading the virus.

With the easing of social and economic lockdown measures, the UK Government currently advises that many sectors including hospitality, leisure, close contact services (such as a pub or barbers/hairdresser) should have a test and trace system in place.

This would normally involve collecting details of people who use close contact services and keeping the records for 21 days. Currently, there is no requirement for trades that go into homes and businesses to have a test and trace system.

However, we believe it’s good practice to implement a procedure to help stop the spread of the virus, and protect your staff and clients.

This guidance document and accompanying ‘Record of employee movements’ template will help pest management companies to implement a test and trace system for their workplace if they haven’t already done so.

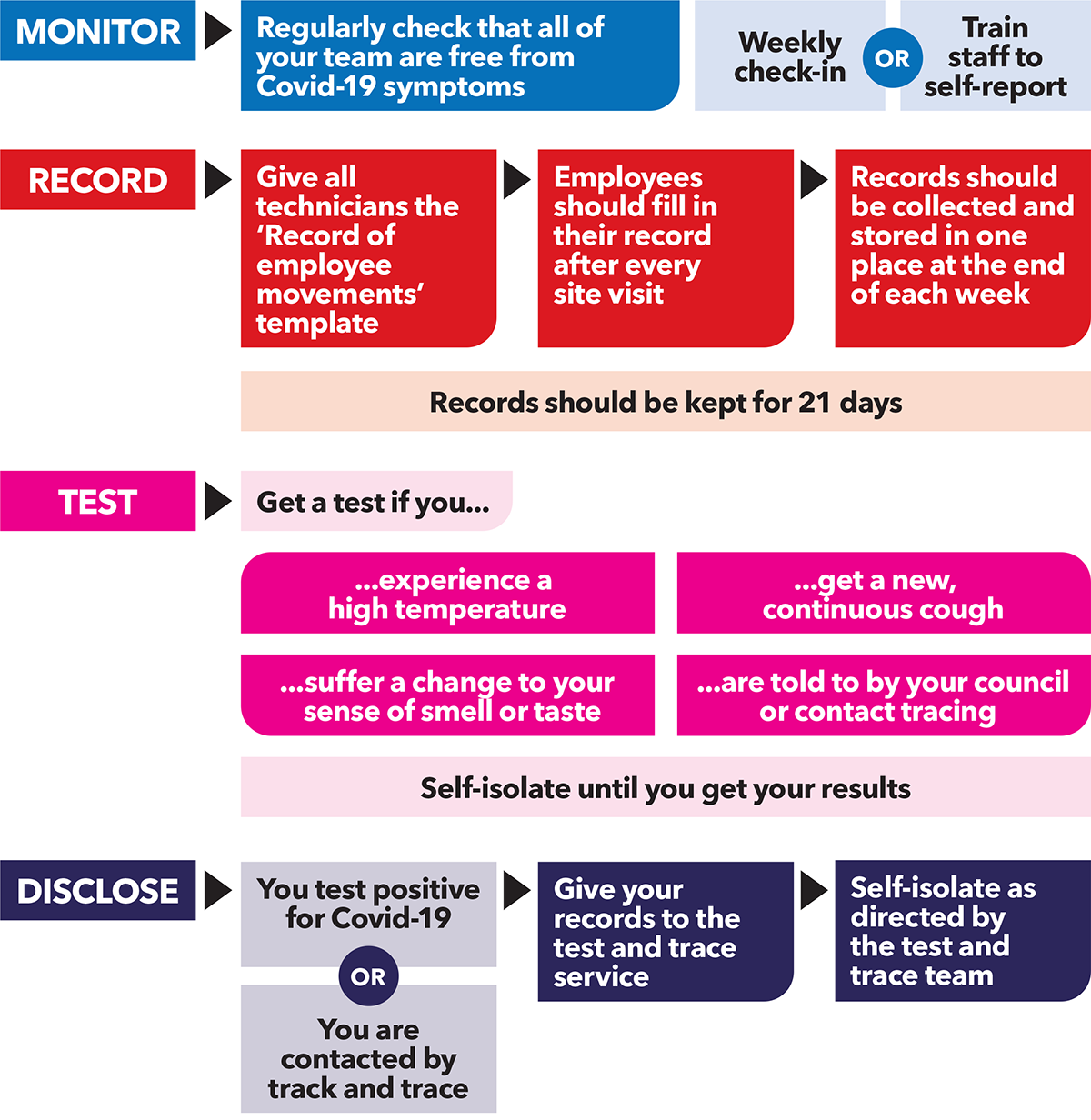

Monitor-record-test-disclose

We've put together a simple flowchart with some advice on monitoring the health of employees, and to help you navigate the test and trace procedure.

About this document

This guidance has been made public, meaning members of the British Pest Control Association (BPCA) and non-members can access our support. We have chosen to release the guidance to everyone to help the whole public health pest management sector minimise the spread of Covid-19.

You can download the full document below.

Download

Further support for BPCA members

The BPCA team has been hard at work creating materials to keep you working safely and protecting your clients during the Covid-19 pandemic.

All members, as well as those companies on the BPCA Probationary Scheme, have access to:

- Back-to-work signage collection

- Cost-benefit analysis of postponing pest control services template

- BPCA ‘pests in a pandemic’ client flyer

- Client communication Covid-19 policy

- Covid-19 toolbox talk template with guidance

- Essential pest management work BPCA sign for van

- BPCA letter of endorsement template for member employees during Covid-19

- Client letter of endorsement template for member employees during Covid-19

- Coronavirus (Covid-19) risk assessment template

- Letter template to MPs - Designation of Pest Management Professional as Key Worker

- Letter template for BPCA members designating pest management professionals key workers Covid-19.

Plus access to:

- Technical support

- Legal advice

- HR and business advice

- Health and safety advice.

Interested in joining BPCA? Contact membership@bpca.org.uk

What has BPCA done to protect its members?

BPCA has written to Rt Hon Alok Sharma MP, Secretary of State for Department for Business, Energy and Industrial Strategy (BEIS) on behalf of our member organisations.

The letter asks that:

- The Government recognises that the pest management work that our members do is critical

- The Government acknowledges pest control and management cannot stop amid this pandemic

- Asks the Government to commit to protecting SMEs in the short term, and accelerate the role out of all announced business contingency plans.

BPCA has also produced this guidance and distributed it amongst all members and affiliates.

BPCA's Technical and Compliance Officer, Natalie Bungay, hosted a webinar on 24 March, to help pest management businesses understand how the pandemic will affect their work, and offer suggestions for mitigating risks involved in doing pest control work.

Our Staff team has put together a comprehensive resource pack, designed to help in a number of ways. See 13 resources for pest professionals during Covid 19 pandemic.

We've also published a frequently asked questions article, to answer some of the queries we've been getting since the outbreak began.

You can download a timeline of BPCA's lobbying efforts below.

Download

Update: Key worker status confirmed by UK government (13 April 2020).

Following extensive lobbying by BPCA and CEPA, pest management has been confirmed as an essential sector during the Covid-19 pandemic by George Eustice, Secretary of State for Environment, Food and Rural Affairs (Defra).

According to Defra, pest management is covered in the key worker list under the "food and necessary goods" section, specifically concerning hygiene.

The Government announced its list of key workers on 20 March 2020 which did not include pest management professionals.

This list of key workers is designed to help schools and local authorities decide which children will need to continue to attend school during the pandemic.

In light of the Government not explicitly adding pest management to the list of crucial sectors in their guidance, BPCA produced a letter template for members to help ensure their employees' children can continue to go to school.

You can read our blog post here on why pest management professionals are key workers.

The guidance slightly differs in Scotland, and can be found here.

Pest professionals are also considered key workers in Northern Ireland, which you can read about here.

You can read the full letter from John Swinney MSP, Deputy First Minister and Cabinet Secretary for Education and Skills, regarding the protection of key interests during the pandemic.

What if my customers cancel/refuse access for routine contracts?

You should respect the decision of your clients to refuse your access to a site to help prevent the spread of Covid-19.

You can discuss with the client the importance of public health pest management, even during the pandemic.

Explain to them what mitigation practices you have or will put into place to reduce the risks to their staff.

Offer pest awareness training and advice over the phone or via video conferencing. Video calling might allow you to do an inspection or survey with the support of a client on-site.

Remind the customer that they can’t use professional use products and shouldn’t touch any bait points.

If you or your client choose for you not to conduct a visit, make sure any glue boards are removed and any live capture traps are deactivated.

Refer to your individual contract, as they might be liable to pay for the visit if they choose not to allow you on-site.

Try and come to mutually agreeable variations and payment terms following the provisions for this made in the contract at all times.

If in doubt, seek professional advice. Remember, this pandemic is going to particularly hit small to medium-sized businesses, especially in the hospitality and events sectors.

Will the Government compensate my business for any loss of work?

England and Wales

Coronavirus Job Retention Scheme

Update: The Job Retention Scheme will end on 30 September 2021.

For claims relating to August and September 2021, the government will pay 60% of wages up to a maximum cap of £1,875 for the hours the employee is on furlough.

For all claims from 1 July 2021, employers must top up their employees’ wages to make sure they receive 80% of their wages (up to £2,500) for the hours they are on furlough. The caps are proportional to the hours not worked.

The Coronavirus Job Retention Scheme will be ending on 30 September 2021. Claims for September must be submitted by 14 October 2021 and any amendments must be made by 28 October 2021.

Find out more about how the scheme is changing.

Claims for furlough days in August 2021 must be made by 14 September 2021.

Tax helpline

A dedicated helpline has been set up to help businesses and self-employed individuals in financial distress and with outstanding tax liabilities receive support with their tax affairs. Through this, businesses may be able to agree a bespoke Time to Pay arrangement. If you are concerned about being able to pay your tax due to Covid-19, call HMRC’s dedicated helpline on 0800 0159 559

VAT deferral scheme

The VAT deferral new payment scheme will be open from 23 February up to and including 21 June 2021.

If you’re on the VAT Annual Accounting Scheme or the VAT Payment on Account Scheme, you’ll be invited to join the new payment scheme later in March 2021.

Find out more here.

Bounce back loans scheme

Businesses will be able to borrow between £2,000 and £50,000, interest-free for 12 months. The scheme launches on Monday 4 May and no repayments will be due for the first 12 months. Businesses can apply online through a short and simple form. Visit the Gov UK website for more info.

Update (24 September 2020): Businesses can now extend their bounce back loans from six to 10 years, reducing payments. Businesses can also move to interest-only payments or suspend repayments for six months if they are "in real trouble" (credit ratings will be unaffected).

Apply for a coronavirus Bounce Back Loan: gov.uk/guidance/apply-for-a-coronavirus-bounce-back-loan

In addition, the Chancellor has announced that additional one-off top up grants will be available for retail, hospitality and leisure businesses worth up to £9,000 per property, to help businesses through to the spring.

This comes in addition to £1.1 billion further discretionary grant funding for Local Authorities, Local Restriction Support Grants worth up to £3,000 a month.

A full list of the financial support available for businesses can be accessed via the Government website.

Self-employment income support scheme

You can now apply for the self-employment income support scheme on the Gov UK website.

The Government has announced it will pay taxable grants worth 80% of average monthly profits over last 3 financial years, up to £2,500 a month.

The scheme will be open to businesses across the UK for at least three months, and may be extended if necessary.

This support will be available for self-employed people making profits of up to £50,000 per annum and to minimise fraud, will only be open to those whose majority income derives from self-employment and who have a tax return from 2019. Those who missed the January filing deadline will have four weeks to submit a tax return in order to be eligible.

More information is available on the Government's Self-employment Income Support Scheme FAQs.

Update (24 September 2020): Further extension to self-employment support scheme

The existing grant scheme for self-employed people is being extended.

- The grant will cover three months' worth of profits for the period from November-January

- It will cover 20% of average monthly profits (capped at £1,875)

- A further grant will be available to the self-employed to cover February 2021 to the end of April.

Check if you’re eligible: gov.uk/guidance/claim-a-grant-through-the-coronavirus-covid-19-self-employment-income-support-scheme

Tax exemptions for home office equipment

To support businesses and their employees who are working at home due to Coronavirus (Covid-19), the government has introduced a temporary new tax exemption.

No income tax or NICs liabilities will be due on reimbursed expenses for the purchase of home office equipment. HMRC will use its discretion to ensure the exemption applies from 16 March 2020 until 5 April 2021.

The exemption will apply to reimbursements of expenses to employees where you instruct or allow them to purchase their own home office equipment where they are working at home due to Coronavirus (Covid-19).

Visit the Gov UK website for more information.

Wales

A £1.1bn support package for the economy and public services in Wales has been announced:

- £500m economy crisis fund for businesses, charities and social enterprises

- £100m will be administered by the Development Bank for Wales to help firms with cashflow problems, including loans between £5,000 and £250,000 with minimal interest payments attached

- £400m will form an emergency fund, giving £10,000 to firms employing fewer than nine people, grants of £100,000 to business with 10 to 250 employees, as well as support for larger companies that are significantly important to Wales and have their headquarters there

- Information on support for the self-employed is available here.

Find out if you're eligible for the Economic Resilience Fund here.

More information can be found on the Business Wales website.

Scotland

New measures to limit the impact of Covid-19 on the business community in Scotland have been announced by Scottish Finance Secretary Kate Forbes.

The following steps will be put in place to support businesses during the 2020-21 financial year:

- Apply for the 3rd grant of the Self-Employment Income Support Scheme. You must make your claim on or before 29 January 2021

- The UK Job Retention Scheme (furlough) will pay 80% of wages of workers on leave. This scheme has been extended until the end of April 2021

- Michelin Development Dundee Fund offers world-class expertise and unsecured loans of up to £50,000 to SMEs operating in any business-to-business sector. Loans can be used for a variety of purposes including capital purchases as long as there is a jobs creation output. Note - this fund is only available to companies operating in Dundee or Angus

- Small businesses can apply for the Coronavirus Business Interruption Loan Scheme (CBILS). They have changed eligibility criteria to make it easier for businesses to access funds. It has been extended until 31 March 2021

- Apply for a coronavirus Bounce Back Loan. Small and medium-sized businesses affected by coronavirus (COVID-19) can apply for a loan of up to £50,000 which will be guaranteed by the UK Government

- The Renfrewshire Coronavirus Business Support Fund is a £1.3 million Renfrewshire Council package of interest free loans and grants providing immediate help to local businesses affected by the pandemic.

The helpline number for businesses in Scotland is 0300 303 0660. The helpline will be open Monday to Friday 8.30 am to 5.30 pm.

Callers should select option one to speak to the Covid-19 team.

Northern Ireland

Businesses in Northern Ireland are being advised to carry out a business impact analysis and draw up a business continuity plan.

Other financial support available:

More decisions are expected to be announced on support for businesses in Northern Ireland.

Ireland

The Irish government offers the following support which will help businesses during the Covid-19 pandemic:

- The Credit Guarantee Scheme supports loans up to €1 million for periods of up to 7 years. Applications can be made to AIB, Bank of Ireland and Ulster Bank. Eligibility criteria apply

- Microenterprises can access Covid-19 loans of up to €50,000 from MicroFinance Ireland. Loans are available at an interest rate of between 6.8% and 7.8%. Businesses can apply through their Local Enterprise Office or directly at microfinanceireland.ie (Eligibility criteria apply)

- The €200m SBCI Covid-19 Working Capital Scheme for eligible businesses will be available within the next week. Maximum loan size will be €1.5 million (first €500,000 unsecured) and the maximum interest rate will be 4%. Applications can be made through the SBCI website at sbci.gov.ie

- A €200m Package for Enterprise Supports including a Rescue and Restructuring Scheme is available through Enterprise Ireland for vulnerable but viable firms that need to restructure or transform their business.

What financial support will I get if I have to self-isolate or if I am diagnosed as having Covid-19?

Eligible for SSP

Statutory Sick Pay (SSP) will now be available for eligible individuals diagnosed with Covid-19 or those who are unable to work because they are self-isolating in line with Government advice.

This is in addition to the news that SSP will be payable from the first day of absence instead of day four for affected individuals.

People who are advised to self-isolate for Covid-19 will soon be able to obtain an alternative to the fit note to cover this by contacting NHS 111, rather than visiting a doctor.

This can be used by employees where their employers require evidence. Further details will be confirmed by the government shortly.

Not eligible for SSP

Those who are not eligible for SSP, for example the self-employed or people earning below the Lower Earnings Limit of £118 per week, should make a claim for Universal Credit or Contributory Employment and Support Allowance (ESA).

- For the duration of the outbreak, the requirements of the Universal Credit Minimum Income Floor have been temporarily relaxed for those who have Covid-19 or are self-isolating in accordance with government advice

- Increase in standard Universal Credit of £20 a week, with the same rise for those still on the working tax credit scheme

- Nearly £1bn for those struggling to pay rent, through increases in housing benefit and Universal Credit

- People will be able to claim Universal Credit and access advance payments upfront without the current requirement to attend a jobcentre if they are advised to self-isolate

- Contributory Employment and Support Allowance will be payable, at a rate of £73.10 a week if you are over 25, for eligible people affected by Covid-19 or self-isolating in line with advice from Day 1 of sickness, rather than Day 8

- Local Authorities will be given access to a £500 million Hardship Fund so they can support economically vulnerable people and households. It is expected that most of this funding will be used to provide more council tax relief, either through existing Local Council Tax Support schemes, or through similar measures. More detail is expected to be released by the government on this funding, including allocations, shortly.

What's happening with BPCA events, training courses and exams?

Update (1 September 2021): events now taking place across the UK.

The UK Government has lifted restrictions on events and BPCA will now be holding in-person events and PestEx in 2022. Training courses and exams are now taking place again.

Previously, the UK Government advised against all unnecessary gatherings to help minimise the spread of Covid-19.

BPCA took the decision to postpone all events, training and exams until at least the end of April 2021.

It’s our first priority to keep everyone safe, including our visitors and staff.

BPCA technical and business support remains available to all BPCA members. Members are encouraged to contact our team for support if they need it.

If you’re worried about recording CPD points, take a look at our free webinars and our CPD quizzes, which can be taken online.

Alternatively, if you’re on BPCA Registered, you can record unstructured CPD points for activities like reading articles, watching videos, personal research and technical discussions over the phone.

What's happening with the BPCA AGM?

Initially the BPCA AGM was postponed, however it eventually took place online on 27 August 2020.

Watch it back below.

Can I still visit the BPCA office?

We have been doing what we can to ensure business continuity during these challenging times, however visits to the BPCA offices in Derby are not recommended.

The health and wellbeing of the BPCA Staff team, as well as your own, needs to take priority.

Our Staff team have begun transitioning back into the office and some meetings will be held as hybrid events, both in-person and over video call.

Please do not stop by the office without an appointment, you will not be allowed to enter the premises.

You can still contact the BPCA team and we will be on hand to help as always.

Mental Health Support

There are, rightly, many concerns about mental wellbeing and how people are coping during this unprecedented time.

Here are some of the ways experts suggest you can limit the impact on your mental health:

- ‘Facts minimise fear’. Misinformation and uncertainty can cause stress, so it’s important to make sure that, if you’re looking for information on Covid-19, you use trusted sources. These include the World Health Organisation and the government

- If you are in isolation, try to stay in contact with people using technology such as video calling

- Keep to your routine as much as possible, exercising regularly and practicing hobbies or interests.

If your employer is a member of the Health Matters Assistance Programme, you can receive free mental health support by visiting their website or calling their helpline number on 0800 988 8809.

You can find more mental health and wellbeing support on the following websites:

nhs.uk/conditions/stress-anxiety-depression/mental-health-helplines/

mind.org.uk/information-support/guides-to-support-and-services/seeking-help-for-a-mental-health-problem/where-to-start/

rethink.org/aboutus/what-we-do/advice-and-information-service/get-help-now/

mentalhealth.org.uk/getting-help

Resources and links

UK Government Information on Covid-19: gov.uk/coronavirus

Coronavirus in Scotland: gov.scot/coronavirus-covid-19/

Northern Ireland: Coronavirus overview and advice: nidirect.gov.uk/articles/coronavirus-covid-19-overview-and-advice

Ireland Coronavirus updates: gov.ie/en/campaigns/c36c85-covid-19-coronavirus/

Travel Advice: Foreign & Commonwealth Office, Travel Advice: China: gov.uk/foreign-travel-advice/china

Latest News from Public Health England: gov.uk/government/organisations/public-health-england

Latest News from Health Protection Scotland: hps.scot.nhs.uk/a-to-z-of-topics/covid-19/

Latest News from Public Health Wales: phw.nhs.wales/topics/latest-information-on-novel-Coronavirus-covid-19/

Latest News from Public Health Agency (NI): publichealth.hscni.net/

NHS Advice- Coronavirus: nhs.uk/conditions/Coronavirus-covid-19/

World Health Organisation- Covid-19 Outbreak: who.int/emergencies/diseases/novel-Coronavirus-2019

Support for those affected by Covid-19 gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-support-for-businesses

Guidance: Further businesses and premises to close: assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/874732/230320_-_Revised_guidance_note_-_finalVF.pdf?fbclid=IwAR2_6-t3nwRGjamNdW1XonlIMMa132l9F5N6HlFKNigLV40gOXBJccqSOnE

Coronavirus - what it means for you

moneyadviceservice.org.uk/en/articles/Coronavirus-what-it-means-for-you

Guidance for Employers on Covid-19: gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/guidance-for-employers-and-businesses-on-covid-19

CIPD Furlough FAQs: cipd.co.uk/news-views/coronavirus/faqs/furlough#74298

Advice and guidance from British Institute of Cleaning Science: bics.org.uk/bicsc-update-to-the-outbreak-of-covid-19-coronavirus/

COVID-19: cleaning in non-healthcare settings: gov.uk/government/publications/covid-19-decontamination-in-non-healthcare-settings/covid-19-decontamination-in-non-healthcare-settings

Disinfection of environments in healthcare and nonhealthcare settings potentially contaminated with SARS-CoV-2: ecdc.europa.eu/sites/default/files/documents/Environmental-persistence-of-SARS_CoV_2-virus-Options-for-cleaning2020-03-26_0.pdf

Guidance on respiratory protective equipment (RPE) fit testing: hse.gov.uk/pubns/indg479.htm

HSE: Arrangements for regulation of chemicals during Coronavirus: hse.gov.uk/news/chemical-regulation-during-coronavirus.htm?utm_source=govdelivery&utm_medium=email&utm_campaign=coronavirus&utm_term=chemicals-1&utm_content=digest-8-apr-20#

HSE: RIDDOR reporting of Covid-19: riddor-reporting-coronavirus.htm?utm_source=govdelivery&utm_medium=email&utm_campaign=coronavirus&utm_term=riddor-1&utm_content=digest-8-apr-20

HSE: Social distancing, keeping businesses open and in-work activities during the coronavirus (COVID-19) outbreak: hse.gov.uk/news/social-distancing-coronavirus.htm?utm_source=govdelivery&utm_medium=email&utm_campaign=coronavirus&utm_term=social-distancing-1&utm_content=digest-8-apr-20

HSE: Advice for employers with homeworkers: hse.gov.uk/toolbox/workers/home.htm?utm_source=govdelivery&utm_medium=email&utm_campaign=coronavirus&utm_term=homeworkers-1&utm_content=digest-8-apr-20

Which?: Advice for small businesses and the self-employed: trustedtraders.which.co.uk/for-traders/articles/coronavirus-advice-for-small-businesses-and-the-self-employed

You can find more advice and information about how Covid-19 could affect your business on the following websites:

Federation of Self-Employed and Small Businesses

Confederation of British Industry

Gov.uk

Source: Online