Furlough is the HR word of the moment, and it’s causing some confusion among employers and employees alike.

What is it and how does it work?

Find out more about the Jobs Support Scheme here.

(Article updated 19 February 2021 to include new information.)

NOTE: This article is updated reguarly with information, however if you spot an error or out-of-date guidance, please get in touch and let us know by sending an email to hello@bpca.org.uk.

In this guide:

Furlough: what does it mean?

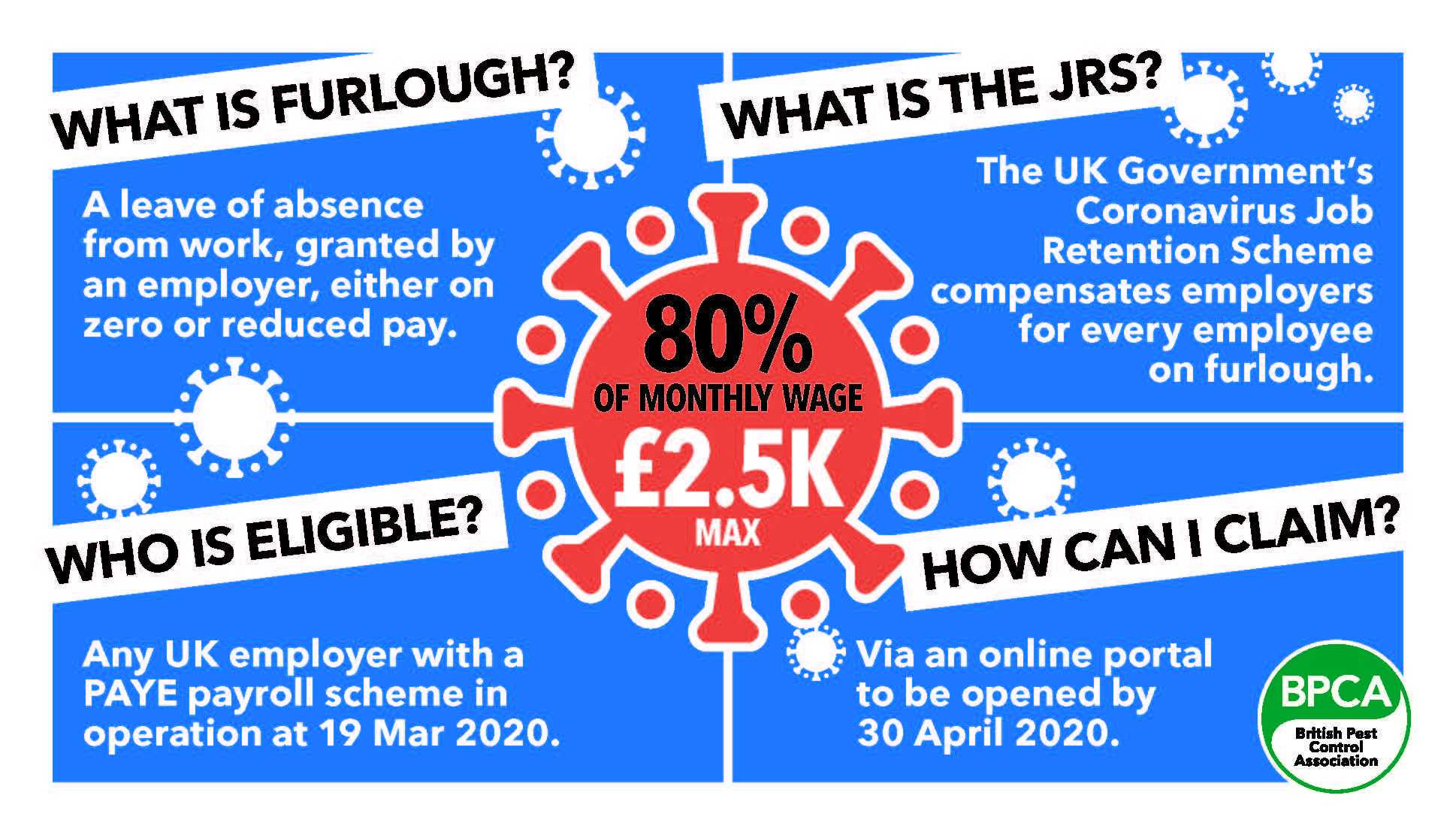

Traditionally, to furlough an employee means to grant them a leave of absence, either on reduced pay or no pay for the duration.

It’s a way for employers to avoid laying people off while saving money in the short-term, and it ensures job security for those employees who have been furloughed.

It is something employees can request, but it must be ultimately granted by the employer.

‘Furloughing’ is not a term we generally use in the UK, being more common in places such as the US.

Coronavirus Job Retention Scheme (JRS)

From Friday 20 March 2020, the chancellor, Rishi Sunak, announced a raft of measures to protect businesses, including government support in the shape of the Coronavirus Job Retention Scheme, allowing employers to ‘furlough’ staff, rather than lay them off or make them redundant.

It is designed to support employees and protect their incomes, when they may otherwise have been laid off due to a downturn in their employer’s operations during the pandemic.

Employers can claim for 80% of furloughed employees’ usual monthly wage costs, up to £2,500 a month, which includes Employer National Insurance contributions and minimum automatic enrolment employer pension contributions.

The JRS is being backdated to the start of March, so if you have recently been laid off as a result of Covid-19 you can call your employer and ask them to reconsider putting you on furlough instead, with the state paying your wage at 80%.

The company can use discretion to top that up to 100% but they don't have to.

It’s important to remember that the initial 80% is not coming out of the employer's pocket.

Update: The Job Retention Scheme has now been extended until the end of April 2021.

You can claim for employees who were employed on 30 October 2020, as long as you have made a PAYE RTI submission to HMRC for this employee between 20 March and 30 October.

Employees can be furloughed for any amount of time or pattern. Employees can be completely furloughed or flexibly furloughed.

Currently, employers will need to pay for the cost of employer NIC and pension costs.

Who can claim under the Coronavirus JRS?

This scheme would enable employers to retain their employees for at least the short term, without having to worry about possible redundancies, also giving employees comfort around their ongoing status and pay for the short term.

The scheme was previously open to all UK employers that had created and started a PAYE payroll scheme on 28 February 2020, allowing them to access financial support to continue to pay part of their employees’ salaries.

However, the government have released further guidance, which has extended the cut-off date for when employees started new jobs to 30 October 2020.

Note: HMRC must have been notified that the employee was on the payroll through RTI submissions on or before 30 October.

Employees could have started working before 30 October, however if the company’s pay run means that HMRC was not notified through RTI submissions, they are unlikely to be eligible for the scheme.

Any UK organisation with employees can apply, including:

- Limited companies

- Sole traders

- LLPs

- Partnerships

- Charities

- Recruitment agencies (agency workers paid through PAYE)

- Public authorities.

If you are PAYE for a contracted employer, the company can put you on furlough under the Coronavirus JRS.

Where a company is being taken under the management of an administrator, for example in the case of rent-to-own retailer BrightHouse, the administrator will be able to access the Job Retention Scheme.

How much can be claimed?

As mentioned, you can claim the lower of £2,500 or 80% of an employee’s wages.

For employees with more than 12 months’ service whose wages vary, you can claim the higher of:

- Same month’s earnings from the previous year

- Average monthly earnings from the 2019-20 tax year.

If an employee has been employed for less than 12 months, then an 80% average of their monthly earnings to date can be taken.

Furloughed staff receiving 80% of their normal wages can receive this amount even if this means, based on their normal contracted working hours, that it would bring them below the normal appropriate minimum wage.

You can claim for any regular payments you are obliged to pay your employees. This includes wages, past overtime, fees and compulsory commission payments. However, discretionary bonus (including tips) and commission payments and non-cash payments should be excluded.

Sickness absence

The Coronavirus Job Retention Scheme is not intended to cover short-term absences, so any employee isolating or on sick leave because of coronavirus should not be furloughed if they will be returning to work once their period of sickness is over. That employee is instead eligible for statutory sick pay from day one of their absence.

However, if employers want to furlough workers for business reasons and someone is currently off sick, they can do so.

The individual would no longer receive SSP and will instead be classed as a furloughed worker.

Employers are able to claim back through the job retention scheme and SSP for the same employee, however not for the same period. An employee is either sick or furloughed at any given time.

If an employees becomes sick while on furlough, they retain their statutory rights, including the right to Sick Pay. This means if a furloughed employee becomes sick they must be paid at least SSP. It is up to the employer to decide whether to keep these employees on furlough or to move them on to SSP.

If an employee moves onto SSP and the absence is not related to the Coronavirus, then employers will be responsible for paying the SSP themselves and will not be able to claim this back. However, should they decide to keep the employee as furloughed, they will be able to continue to make a claim for the employee through the Job Retention Scheme.

How to claim

Claims will be made through an online portal, which has now been rolled out (20 April 2020).

You can access the HMRC portal here: gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme

You can also apply for a number of other financial schemes designed to help businesses weather the Coronavirus storm.

Throughout this period, you should be furloughing employees wherever necessary and appropriate.

You should consider allowing furlough for employees who are in the “at risk” category and have been told by Public Health England to self-isolate. This is known as "shielding".

This scheme is designed to protect incomes and to help mitigate the spread of Coronavirus.

If an employee is in the “at risk” category but has been informed that they must work or face 12 weeks’ unpaid leave, they are almost certain to ignore self-isolation guidance and continue working, leaving themselves exposed to the virus.

Furlough should also be considered for staff who have childcare issues, unable to take their children to school and with no alternative options but to stay home. Although pest management is essential work, school places are limited for children of key workers.

You must ensure that you either seek agreement to changes employees’ contracts of employment or that you already have the contractual right to do so.

To claim, you will need:

- Employer PAYE reference number

- Number of employees being furloughed

- National Insurance Numbers for the furloughed employees

- Names of the furloughed employees

- Payroll/employee number for the furloughed employees (optional)

- Self Assessment Unique Taxpayer Reference or Corporation Tax Unique Taxpayer Reference or Company Registration Number

- Claim period (start and end date)

- Amount claimed (per the minimum length of furloughing of 3 consecutive weeks)

- The relevant bank account number and sort code

- Your contact name

- Your phone number

You will need to calculate the amount you are claiming. HMRC will retain the right to retrospectively audit all aspects of your claim, so you should keep these records for at least five years.

If you have fewer than 100 furloughed staff you will be asked to enter details of each employee you are claiming for directly into the system – this will include their name, National Insurance number, claim period and claim amount, and payroll/employee number (optional).

If you have 100 or more furloughed staff you will be asked to upload a file with the information, rather than input it directly into the system. They will accept the following file types: .xls .xlsx .csv .ods.

The file should include the following information for each furloughed employee:

- Name

- National Insurance number

- Claim period and claim amount

- Payroll/employee number (optional)

Furloughing and pest management emergencies

A number of BPCA members have asked if furloughed employees can still carry out emergency call outs.

From 1 July 2020, employers were informed that they would be able to furlough employees on a part-time basis. This is known as the Flexible Furlough Scheme.

Employees can work for any amount of time under flexible furlough, and any work pattern but they cannot do any work for you during hours that you record them as being on furlough.

If you flexibly furlough employees, you will also need to agree this with the employee (or reach collective agreement with a trade union) and keep a new written agreement that confirms the new furlough arrangement.

Employers do not have to take all employees off permanent furlough, so therefore could have some employees remaining on furlough and some on flexible furlough to help meet the needs of the business.

In order to flexibly furlough employees, employers will need to seek the agreement of employees and should keep a written record of the flexible furloughing agreement.

HMRC will be able to carry out restrospective audits of businesses which have used the scheme, so employers should ensure that the agreement is kept on record for up to 5 years, as well as ensuring that a record of all hours worked are kept on file for up to 6 years.

You can calculate how much you can claim for an employee on flexible furlough on the government website.

HMRC will be able to carry out restrospective audits of businesses which have used the scheme.

Important information for making flexible furlough claims

It's important to note that claim periods starting on or after 1 July must start and end within the same calendar month and must last at least 7 days unless you’re claiming for the first few days or the last few days in a month.

You can only claim for a period of fewer than 7 days if the period you are claiming for includes either the first or last day of the calendar month, and you have already claimed for the period ending immediately before it.

For example, you couldn’t submit your first claim for a single 1 week period between 29 July 2020 and 4 August 2020.

Please also be aware you should match your claim period to the dates you process your payroll, if you can.

You can only make one claim for any period so you must include all your furloughed or flexibly furloughed employees in one claim, even if you pay them at different times. If you make more than one claim, your subsequent claim cannot overlap with any other claim that you make.

Where employees have been furloughed or flexibly furloughed continuously (or both), the claim periods must follow on from each other with no gaps inbetween the dates.

You can claim before, during or after you process your payroll; you can usually make your claim up to 14 days before your claim period end date and you do not have to wait until the end of a claim period to make your next claim. Claims for periods after 30 June can be made from 1 July.

When claiming for employees who are flexibly furloughed you should not claim until you are sure of the exact number of hours they will have worked during the claim period. This means that you should claim when you have certainty about the number of hours your employees are working during the claim period.

If you claim in advance and your employee works for more hours than you have told HMRC about, then you will have to pay some of the grant back.

Payments will be made 6 working days after you make your claim.

FAQ

Here are some common questions people ask HMRC about the CJRC.

Will information for each branch of an employer’s company be published separately?

If there is more than one PAYE scheme attached to a company, HMRC will publish their information together under one Company Registration Number on GOV.UK.

How does an employer ask HMRC not to publish their claim details?

If publishing an employer’s claim details could leave someone at risk of violence or intimidation, they can request for these not to be published by completing the online application form. Employers need to submit their request by 23 February at the latest to allow HMRC time to process the request before the publication date. You can do this on your client’s behalf.

HMRC will not publish an employer’s details until they have informed them of their decision on their request. Employers only need to make this request once, as the decision will cover all CJRS claim periods starting from 1 December 2020.

What happens if an employer pays back their grants?

If an employer chooses to pay back the money they have received, their details will be removed from the list of claims when it is next published (usually in the following month).

Can an employee work elsewhere if they’re furloughed?

If an employee has more than one employer they can be furloughed for each job. Employees can be furloughed in one job (and receive that furloughed payment) but continue working for another employer and receive their normal wages.

An employee can also take part in volunteer work during hours when they are furloughed, as long as it’s for another employer or organisation which is not connected with their own employer.

Can I claim for employees who are training?

You or your clients can claim for employees who undertake training while they are furloughed, as long as they don’t provide services to, or generate revenue for your client's business or a linked or associated organisation. There’s more information on training available for employees on GOV.UK.

Can I furlough an employee if they are unable to work because they have caring responsibilities or are classed as clinically extremely vulnerable?

If an employee asks to be furloughed, you or your clients can claim for them under the CJRS if:

• They are off work or on reduced hours due to caring responsibilities resulting from coronavirus, such as caring for children who are at home as a result of school or childcare closing

• They are clinically extremely vulnerable, or in the highest risk group for severe illness from coronavirus according to the public health guidance for your area.

For other circumstances where you can furlough an employee, go to check which employees you can put on furlough. The decision to offer furlough rests with the employer.

What should I do if I suspect fraud?

HMRC will check claims, and payments may be withheld or need to be paid back if a claim is found to be fraudulent or based on incorrect information.

You need to report fraud to HMRC if you have evidence to suggest an employer is abusing the scheme.

Where can I get further support?

Thousands of people have benefitted from the HMRC webinars which offer support on the CJRS, and how it applies to you or your clients. Go to help and support if your business is affected by coronavirus to book online, or to view updated guidance. If you’re booked on a webinar but can no longer attend, please cancel your place where possible to allow space for others to register.

There’s a list of monthly claims deadlines and a helpful step-by-step guide on GOV.UK, summarising the latest information on the CJRS and the steps you need to take to make a claim – you can find these by searching 'Job Retention Scheme step by step guide'.

HMRC phone lines and webchat remain very busy, so the quickest way to find the support you need is on GOV.UK. This will leave phone lines and webchat service open for those who need them most.

MORE HR SUPPORT

For more advice, members have free access to BPCA Business Shield, an online portal which gives you access to Health and Safety, Environmental and Employment Law advice and guidance.

BPCA Business Shield

Source: Online